"We Got Tired of Working in a Broken System... So, We Left It and Built Something Better."

Why Kedrec Wealth?

We believe anyone can build wealth, but no one is entitled to it. That’s why we make it easy for anyone to access financial professionals who can guide anyone towards accomplishing their financial goals.

One Mission. Seven Guiding Principles.

Our mission is to help people develop a healthier relationship with money so that they are less likely to experience financial stress. We believe that with comprehensive, holistic financial planning, and a deep understanding of human behavior (emotional intelligence), anyone can build lasting wealth.

#1: Anyone Can Become Wealthy

We believe wealth isn’t reserved for the privileged... it’s available to anyone willing to plan with purpose. Building lasting wealth isn’t about luck or complexity; it’s about consistent action, smart decisions, and aligning your money with your life.

With the right guidance and intentional habits, we believe anyone can build wealth while still enjoying life along the way.

#2: Fees Should Be Flat and Transparent

We believe financial advice should come with clarity, not confusion or conflicts of interest. That’s why we charge flat, transparent fees that are easy to understand and never tied to how much money you have or where the money is placed.

You deserve to know exactly what you're paying for and why. No hidden costs. No percentage games. Just straightforward pricing that puts the focus where it belongs... on your goals.

#3: Nothing is Perfect

There's no such thing as a perfect investment, product, or strategy. Nothing does everything well. We view investments and products as tools to be used when suitable and strategically appropriate.

Just like you wouldn’t use a hammer to cut wood, or a saw to hit a nail, we feel strongly that you shouldn’t use an investment or product just because it’s popular or appears to be perfect. The right tool depends on the job. The right investment or product recommendation will depend on what you want your money to do for you and how it fits into the plan.

#4: Diversify Your Assets by Strategy

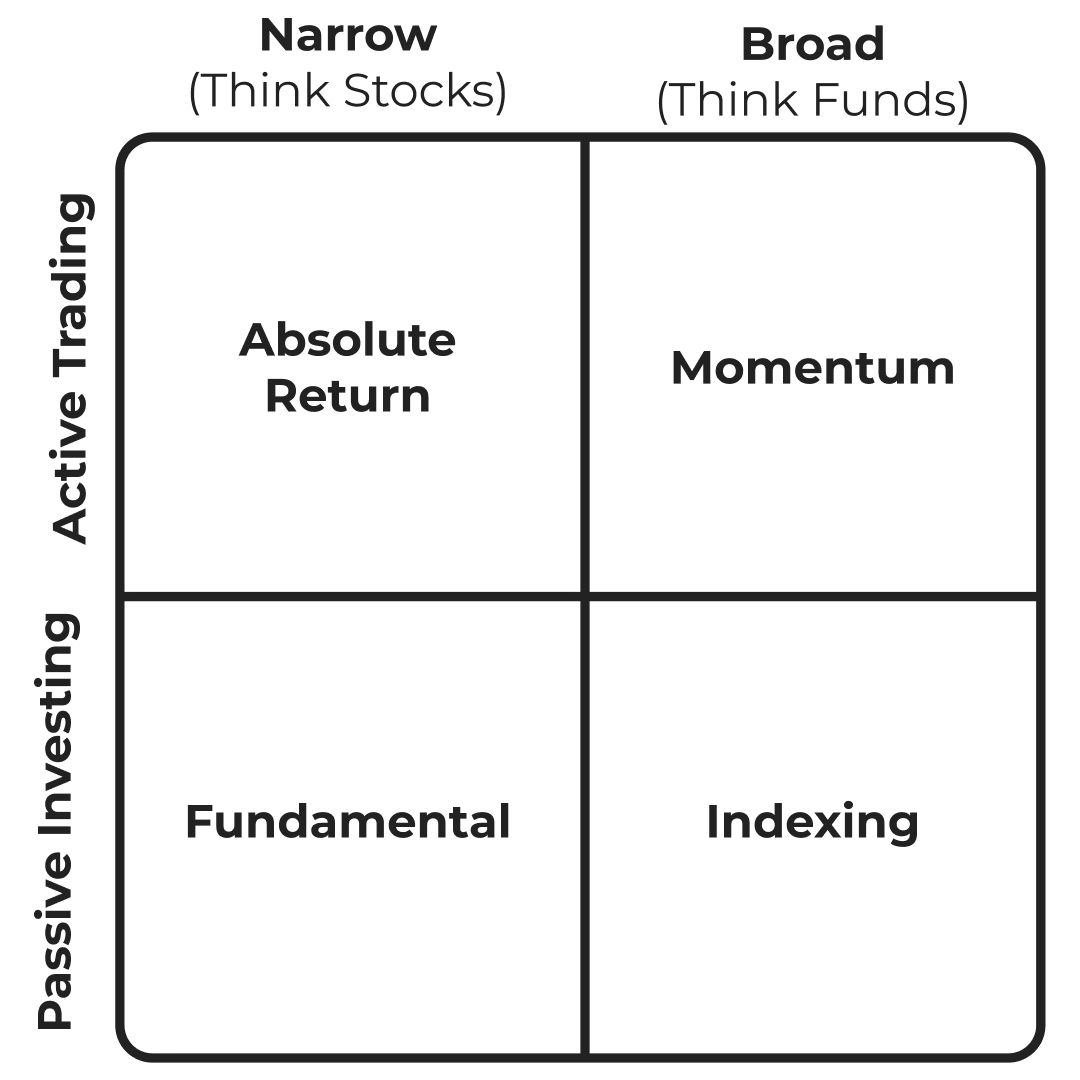

Instead of arguing if active management is better or worse than passive management, or if stock picking is better than buying funds, why not blend the different investment strategies? Here are our four core investment strategies and their individual approaches.

Absolute Return (Active/Stocks): Seeking growth regardless of market conditions through short-term trades.

Momentum (Active/Broad): Seeking growth by shifting ETFs into sectors that have reasonable growth potential.

Fundamental (Passive/Stock): Seeking growth by investing in high quality companies for a reasonable price with the intention of holding them for a long-term period of time.

Indexing (Passive/Broad): Seeking growth by buying and holding high quality indexes such as the S&P 500 or the NASDAQ 100.

How much should go in each quadrant? That depends on your specific situation and your lifestyle and legacy goals. This is why we believe it is important to diversify your assets by investment strategies.

Growth is one part of a portfolio. If you are young, you may have a significant part of your portfolio focused on growth. If you are retired or near retirement, you may have less focused on growth, and more is investments or products that help preserve your wealth. It all depends on your plan and the purpose of your money.

#5: The Bear Market Protocol

Most people seem to invest with one thing in mind: growth. However, when markets crash (a bear market), panic tends to set in. Just remember: "bad news bears."

We believe downturns are part of the journey, not the end of the story. That’s why we prepare for bear markets before they happen. We believe it is important to have some of your portfolio in investments or products that can't lose money. That way, when the markets crash, you can pull funds out of those protected accounts as needed while you wait for your other accounts recover.

For younger individuals, that may mean having six months of income set aside. For retirees, then may mean having a couple of years of income set aside. It all depends on your situation and what is right for you. The trick is knowing what investments and products are out there and how do you bring it all together. There's more to consider than a high-yield savings account or a rolling CD ladder.

#6: Everything Affects Everything

We believe your financial life shouldn’t be managed in pieces. Investments, taxes, insurance, income, estate plans... they all impact each other. When these areas are handled in isolation, opportunities are often missed, and mistakes get expensive.

That’s why we take a coordinated, comprehensive approach. By bringing every piece of your financial life together, we help you create a plan that’s not just efficient, but built to work as one, unified strategy. When everything affects everything, alignment is everything.

#7: Make Ongoing Support Optional

Times have changed. Today, you can manage a portfolio from your phone while you are enjoying brunch with your friends. We believe you shouldn’t be locked into expensive, ongoing relationships just to get access "good advice."

Some people want a full-service experience. Others want a one-time plan and the freedom to run with it. Either way, we’re here to support you on your terms. It's all about trying to do what is right for you.

Ready to See What’s Possible with Your Money?

Whether you're just getting started or nearing retirement, a 30-minute call could change everything.

Explore Your Lifestyle and Legacy Potential™

Tel: 855-553-3732

9393 W 110th St Suite 100

Overland Park, KS 66210

This content on this website is provided for informational purposes only and is not intended to serve as the basis for financial decisions. It should not be construed as investment advice or a recommendation.

Investment advisory services are offered through Kedrec, LLC, a Kansas state Registered Investment Advisor. Insurance products and services are offered through its affiliate, Kedrec Legacy, LLC. We are not affiliated with the US government or any governmental agency.

Investing involves risk, including possible loss of principal. No investment strategy can guarantee success, ensure a profit or guarantee against losses. Insurance product guarantees are backed solely by the financial strength and claims-paying ability of the issuing company.

Insurance and annuity products involve fees and charges, including potential surrender penalties. Annuity withdrawals are subject to ordinary income taxes and potentially a 10% federal penalty before age 59-1/2. Life insurance generally requires medical and potentially financial underwriting to qualify for coverage. Optional features and riders may entail additional annual cost. Product and feature availability may vary by state.